In the quest for sustainable and effective ways to mitigate climate change, biochar has emerged as a notable contender. The concept of biochar is relatively straightforward—it refers to charcoal produced from organic materials through a process known as pyrolysis. This intriguing carbon-rich substance not only enhances soil health but also plays a pivotal role in carbon sequestration. However, as carbon credits become more ubiquitous, the question arises: “How much is biochar really worth in the carbon credit market?”

To embark on this journey of worth assessment, we first need to unravel the mechanics of carbon credits. Essentially, carbon credits serve as a currency in the fight against climate change, where one credit equals the prevention or removal of one metric ton of carbon dioxide from the atmosphere. With regulations increasingly favoring carbon reduction initiatives, businesses, both large and small, are keenly interested in carbon credits to hedge against their emissions.

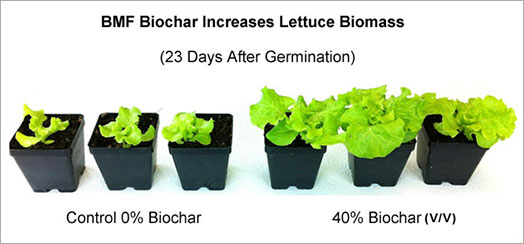

Now, what elevates biochar in this burgeoning marketplace? At its core, biochar is a **sustainable soil amendment** that absorbs carbon and withstands decomposition for centuries. The longevity of carbon sequestered in biochar means that it is not only a temporary fix but a long-term solution that has significant implications for greenhouse gas (GHG) reduction strategies. The potential of this compound seems vast, but with all that promise comes an equally intriguing dilemma: how do we accurately quantify its value?

As biochar’s popularity surges, various methodologies for assessing its carbon credit value have emerged. Two prime factors play an instrumental role: the production method and the type of feedstock utilized. The feedstock, or the raw material from which biochar is produced, can vary widely—from agricultural residues to forestry remnants. This diversity can significantly affect the **carbon sequestration potential** of the resultant biochar. For instance, biochar derived from fast-growing biomass may yield different carbon benefits compared to that sourced from slower-growing tree trunks.

Moreover, the production technology utilized also impacts the carbon footprint. High-temperature pyrolysis systems may capture more volatile organic compounds, enhancing biochar’s carbon retention capabilities. Conversely, low-efficiency methods could diminish that potential, leading to a direct correlation between production methods and carbon credit eligibility. What happens, then, when businesses and communities invest in biochar production without a clear understanding of these varying methodologies? The specter of lost value looms large.

Proceeding further, let’s explore the actual market dynamics of biochar carbon credits. Presently, the trading prices for carbon offsets can oscillate dramatically based on geographical regions, regulatory frameworks, and the overall demand for carbon credits. For biochar credits, prices generally range from $3 to $50 per ton, depending on local carbon markets and the credibility of the certifications attached to the biochar. This leap in value brings to light another question: are companies ready to invest in biochar knowing that the worth of carbon credits might fluctuate unpredictably?

Next, consider the regulatory landscape. Governments worldwide are increasingly introducing measures to promote carbon reduction through initiatives that may incorporate biochar. However, the inconsistency in regulations leads to uncertainties. Some countries have established frameworks for biochar credits, while others remain ambiguous. Businesses seeking to leverage biochar for carbon credits face a challenge here—how do they navigate this labyrinth of regulations and certifications to ensure they are not merely spinning their wheels?

Moreover, manipulating the **land-use changes** associated with biochar production raises another ethical dilemma. Utilizing arable land for biomass production can lead to conflicts over land use, potentially displacing food production. This relationship complicates the narrative of biochar as a carbon mitigation strategy, introducing questions about sustainability and ethical responsibility in carbon credit allocation.

As one delves deeper into the world of biochar and its potential carbon credit viability, the interplay between scientific research and practical application becomes evident. A robust body of research substantiates claims regarding the benefits of biochar for soil health, water retention, and nutrient availability. Nevertheless, the challenge lies in translating this knowledge into actionable strategies for carbon credit generation. How can researchers and policymakers collaborate effectively to bridge this gap?

Looking forward, the question remains: could biochar be integrated into **climate smart agriculture** initiatives as a broader strategy for carbon credit generation? The synergy between improved agricultural practices and biochar utilization could create a fertile ground for generating a vast array of environmental benefits, including enhanced biodiversity. Projects that intertwine these elements might not only capture significant carbon but also yield additional revenue streams for farmers through carbon markets.

Ultimately, the worth of biochar in the carbon credit arena is as intricate as the technology and processes involved in its creation. While its potential value is evident, businesses must carefully navigate the dynamic and sometimes treacherous waters of regulations, market fluctuations, and environmental ethics. In embarking on this journey, it may be prudent for stakeholders to ask themselves: Are the potential financial gains worth the risks, or could investing in biochar yield direct environmental benefits that transcend monetary valuations?

As the dialogue surrounding biochar continues to evolve, stakeholders must adopt a multifaceted approach to understanding its carbon credit potential. The synthesis of scientific research, sound policy, and ethical considerations will be paramount in determining whether biochar can claim its rightful place as a protagonist in the climate change narrative. Whether its value in carbon credits will rise or fall remains to be seen, yet the conversation has only just begun.